Bitcoin has deepened its decline up to now day with its value now slipping under $63,000. Right here’s the place the subsequent potential assist is, in response to on-chain knowledge.

Bitcoin May Discover Assist At These Value Ranges

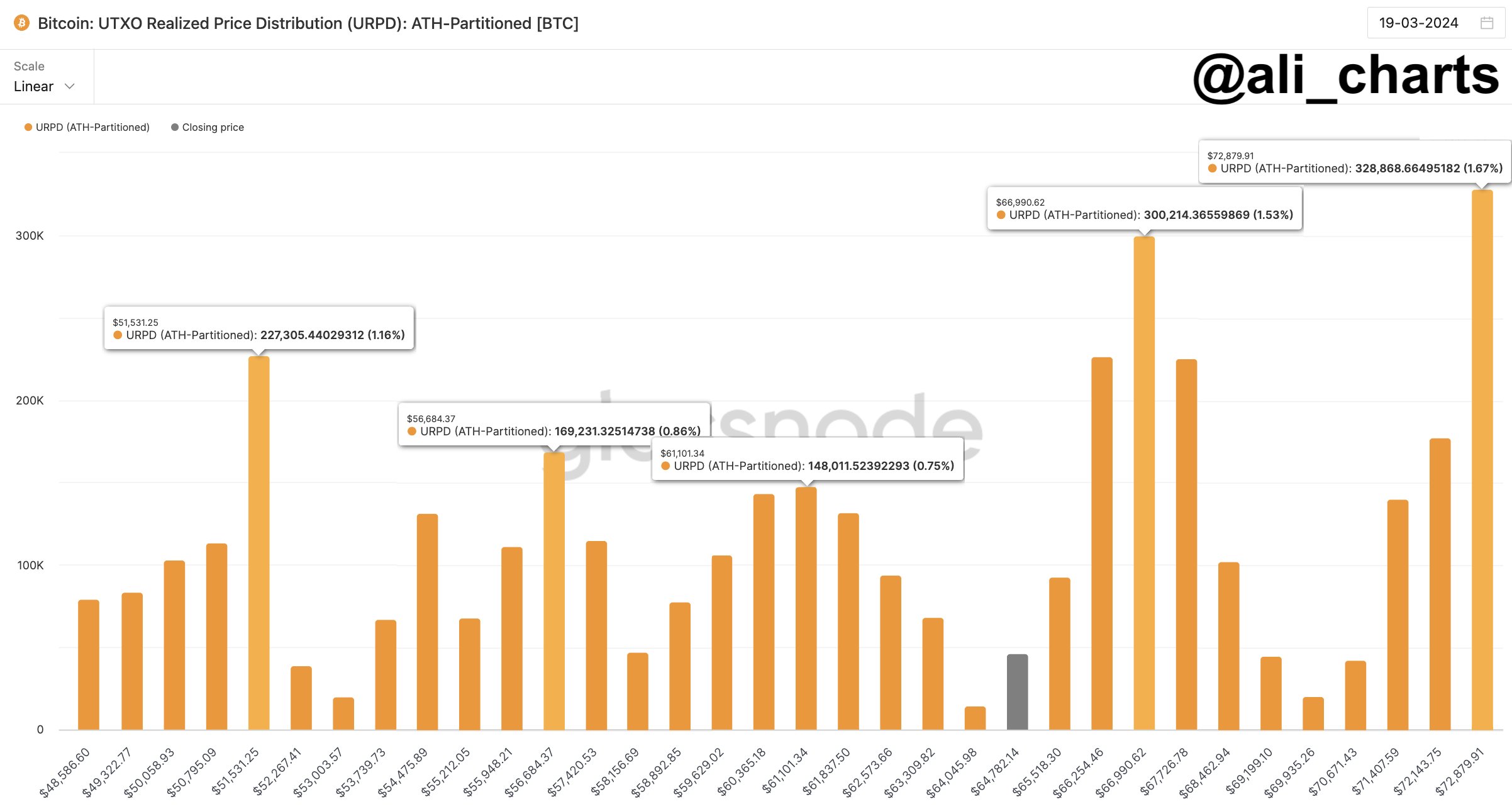

In a brand new publish on X, analyst Ali has mentioned how the Bitcoin assist and resistance ranges are trying like proper now based mostly on on-chain knowledge from Glassnode.

The indicator of relevance right here is the “UTXO Realized Value Distribution” (URPD), which, briefly, tells us in regards to the quantity of cash (or extra exactly, UTXOs) that have been final bought at any given value stage that the asset has visited in its historical past to this point.

Under is the chart shared by the analyst that exhibits the information for this distribution for the value ranges across the current spot worth of the cryptocurrency:

Appears to be like just like the $72,880 mark is the extent with the richest quantity of cash in the meanwhile | Supply: @ali_charts on X

From the graph, it’s seen that there are a number of value ranges not removed from the present one which notably stands out by way of the quantity of shopping for that passed off at them.

In on-chain evaluation, the potential for any stage to behave as assist or resistance relies on the full variety of cash which have their price foundation on the stage in query.

Ranges thick with cash which might be located underneath the present value could be possible to behave as factors of assist, whereas these above the spot worth may show to be resistance partitions.

As is obvious from the graph, the $61,100, $56,685, and $51,530 ranges are those under the present value that maintain the associated fee foundation of a notable quantity of the availability proper now. Naturally, because of this ought to the decline proceed additional, these could be the degrees to look at for a potential rebound.

Two ranges above, nonetheless, are even bigger than all three of those assist ranges: the associated fee foundation facilities round $66,990 and $72,880. Apparently, the latter of those is the only largest acquisition stage out of all the value ranges listed within the chart, implying that a considerable amount of FOMO shopping for has occurred on the asset’s all-time excessive ranges.

Within the state of affairs that Bitcoin regains its upward momentum, these ranges of excessive price foundation inhabitants could be the place the asset could possibly be most possible to search out some hassle.

Now, as for why acquisition facilities are thought of related for assist and resistance in on-chain evaluation is the truth that buyers are more likely to present some sort of response when a retest of their price foundation takes place.

When such a retest is from above, the holders might determine to build up extra, believing that the value will go up once more sooner or later. Alternatively, they could promote as a substitute if the retest is from under, as they could suppose exiting at break-even is best than risking one other drop.

Numerous cash having their price foundation on the similar stage means a probably giant diploma of one among these reactions taking place and, therefore, a powerful assist or resistance impact on the value.

BTC Value

Bitcoin is inching nearer to the primary main on-chain assist stage because it has now dropped to $62,700.

The value of the asset seems to have plummeted over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.

+ There are no comments

Add yours