Ethena is a project developed to address the issues of existing stablecoins in the cryptocurrency market.

What is Ethena (ENA)?

Ethena is a cutting-edge decentralized finance (DeFi) protocol built on the Ethereum blockchain. It is designed to generate synthetic dollars, which are digital assets that maintain price parity with the US dollar (USDe).

The ENA token is the native governance token of the Ethena protocol. Through the use of smart contracts, Ethena allows users to mint, trade, and exchange synthetic dollars without the need for a central authority or intermediary. This provides users with greater control over their funds and financial transactions.

The ENA token plays a crucial role in the governance and operation of the Ethena protocol. Holders of the token have voting rights in the decision-making process of the protocol, such as proposing and voting on changes to the protocol parameters or upgrades.

Additionally, the ENA token can be staked to earn rewards in the form of transaction fees generated by the protocol. This incentivizes token holders to actively participate in the protocol, contributing to its security and stability.

Overall, Ethena aims to revolutionize the way decentralized finance operates by providing a reliable and transparent platform for users to access synthetic dollars and participate in the governance of the protocol.

Why is Ethena Labs important?

Ethena provides a vital solution within the growing DeFi sector. Synthetic dollars play a key role in various DeFi applications, including:

- Stablecoin for trading: Provides traders with a price-stable asset for crypto trading within the volatile crypto market.

- Lending and borrowing: Enables users to lend and borrow assets with stable value.

- Yield generation: Allows users to earn a yield on their crypto holdings with less risk compared to other cryptocurrency assets.

How does the Ethena protocol work?

Ethena maintains a collateral pool of cryptocurrency assets, primarily Ethereum. Users can deposit collateral to mint synthetic dollars. The protocol uses a complex system of algorithms and incentives to maintain the price stability of its synthetic dollars. ENA token holders play a part in governance decisions and help shape the future of the protocol.

Should I invest in the Ethena (ENA) token?

Determining whether or not to put your money into ENA is an individual choice. It is important to extensively study Ethena Labs, including the protocol, tokenomics, team, and roadmap. Take into account your risk tolerance and overall investment approach. Making an investment in the Ethena (ENA) token should be thoughtfully evaluated.

Here are some advantages and disadvantages to assist you in making an educated decision.

Ethena advantages:

- Impressive idea

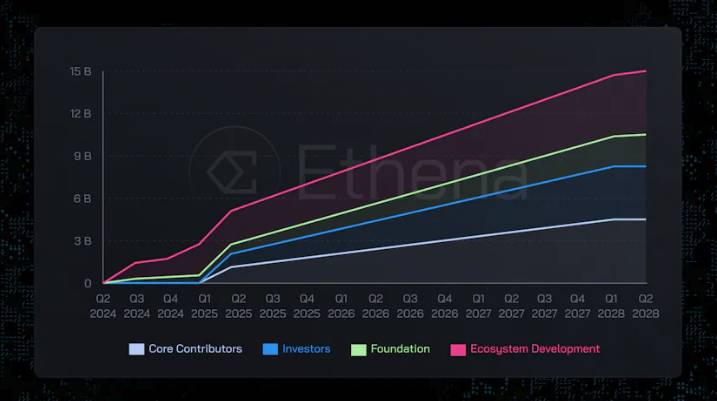

- An effective vesting plan

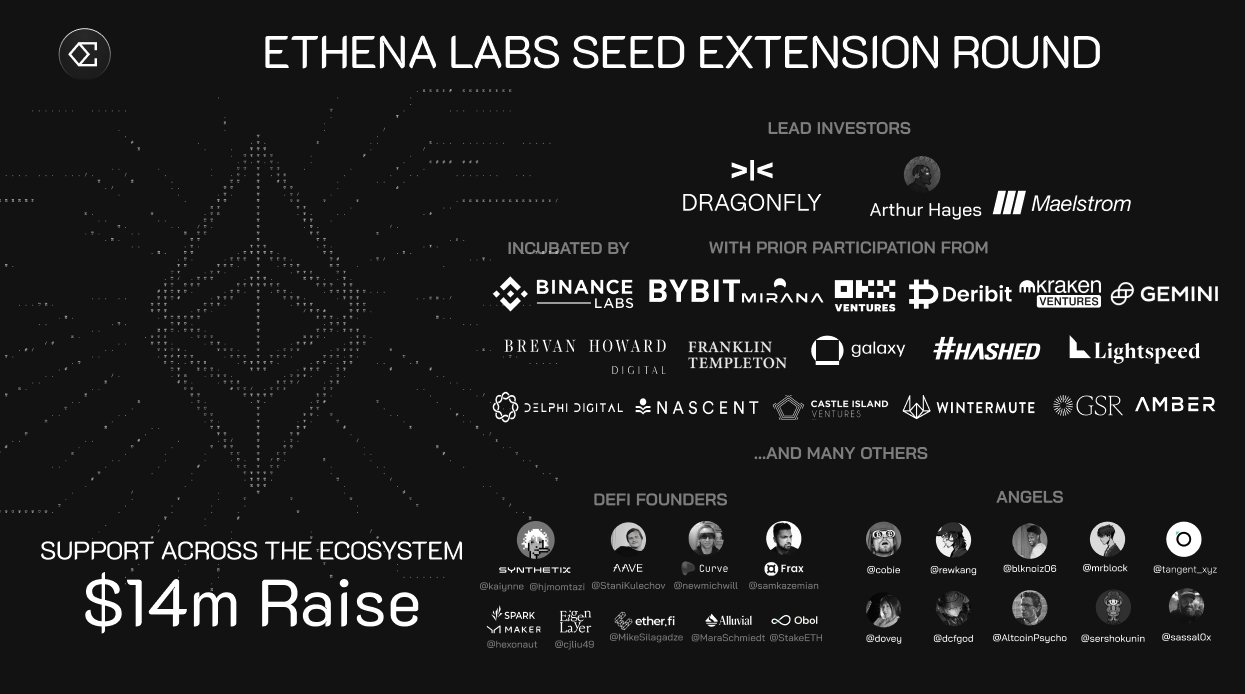

- Backed by top-tier funds

- Extensive network of top-tier partners

- Successful PR and growth marketing efforts

- Effective influencer marketing campaigns

- Undergone multiple security audits and bug bounty programs by reputable companies

- Comparatively low Initial Market Cap/Fully Diluted Valuation (FDV) ratio (9.5%)

- Experienced executive team

| Token Name | Ethena |

| Ticker | ENA |

| Blockchain | Ethereum |

| Token Standard | ERC-20 |

| Contract | To be updated |

| Token Type | Governance |

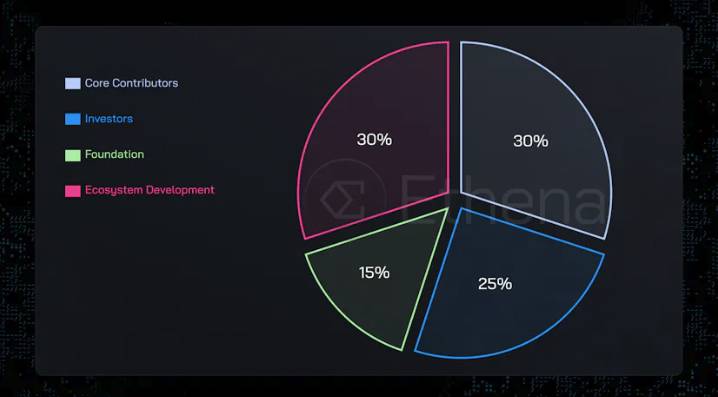

| Total Supply | 15,000,000,000 |

| Circulating Supply | To be updated |

Ethena disadvantages:

- Because of its intricacy, the protocol carries substantial risks associated with its delta hedging approach.

- Damage to reputation caused by the failure of Terra or Luna.

It is important to note that investing in any cryptocurrency carries inherent risks, and it is crucial to conduct thorough research and consider your own risk tolerance before making any investment decisions.

What is Delta-Hedging?

Delta-Hedging, also known as Delta Neutral Trading Strategy, is used to generate income when the market lacks direction. Though that’s the definition, in practice, there are numerous methods to apply it, and the common goal of these methods is to eliminate price volatility and earn profits.

This means that the user’s position remains unchanged amidst market fluctuations. When applied to the cryptocurrency market, the most commonly used investment method is to balance the user’s portfolio to zero, creating a hedge, and earning profits from other methods such as IDO, Airdrop, Staking, Farming, etc.

Conclusion

Ethena is a project issuing a stablecoin based on the delta-neutral investment method, currently attracting significant attention from the investor community. Coinbold provides only general information, not investment advice.