The bulls had been firmly in management on Friday as increased GDP progress forecast, dovish commentary from RBI and hopes of political stability on the Centre took the benchmark indices to contemporary all-time highs.

- Additionally learn:Inventory market at present: Sensex hits all-time excessive, as RBI raises GDP progress projection

The Reserve Financial institution of India revised its GDP progress forecast to 7.2 per cent for 2024-25 from 7 per cent earlier. Coalition companions pledged their assist for the BJP-led Nationwide Democratic Alliance, with Narendra Modi as chief.

The European Central Financial institution lower rates of interest by 25 bps, for the primary time in practically 5 years, reviving hopes that the US Fed might observe go well with in September. Brent crude oil costs declined for the third straight week as the newest OPEC+ resolution raised issues over potential provide surplus.

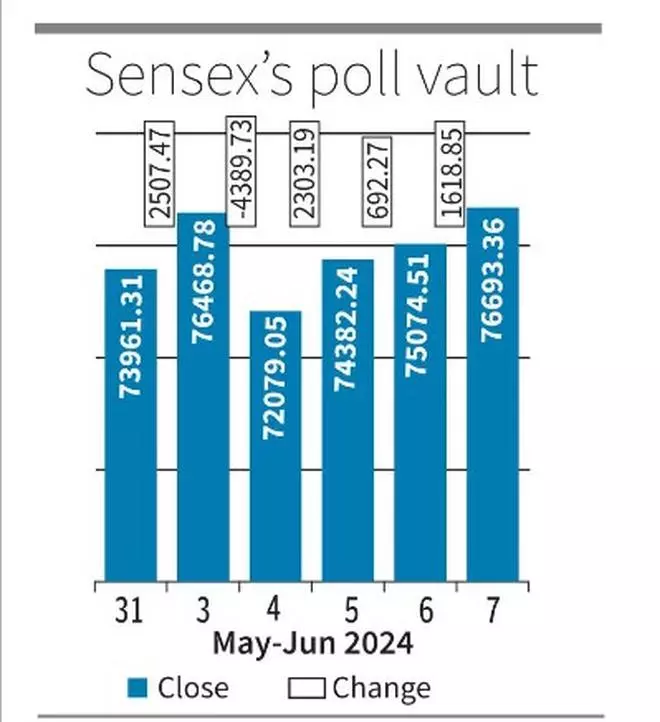

The Sensex rose 1,618 factors or 2.16 per cent to shut at 76,693 on Friday, whereas the Nifty settled at a closing excessive of 23,290. Poor ballot ends in Uttar Pradesh had been a significant setback for the BJP, triggering a panic fall on Tuesday. The Nifty, nonetheless, has staged a comeback within the final three periods, up 6.4 per cent, the very best three-session acquire since February 2021. The index rose 3.4 per cent through the week, recouping all losses made on June 4.

All sectors resulted in inexperienced on Friday with IT being the largest winner, up greater than 3 per cent, adopted by curiosity delicate sectors comparable to auto and actual property. Nifty VIX, a worry gauge, dropped to a one-month low of 16, signalling lowered market nervousness over authorities formation.

Vinod Nair, Head of Analysis, Geojit Monetary Providers, mentioned: “The anticipation of stability inside the coalition authorities on the Centre and the RBI’s upward revision of its progress forecast fuelled a broad-based rally. Although the final mile in the direction of the inflation goal stays sticky, traders expect the MPC to be one step nearer to the easing cycle.”

FPIs had been consumers on Friday to the tune of ₹4,391 crore whilst home establishments offered ₹1,289 crore.

- Additionally learn:RBI ups GDP progress projection for FY25 at 7.2%

Most Asian indices had been within the crimson on Friday, with Jakarta Composite the highest loser. US jobless claims knowledge got here in at 229,000, barely above the anticipated 220,000.

The federal government’s 100-day agenda and allocation of key cupboard portfolios will present cues subsequent week. Quick-term development for the Nifty stays robust, with resistance at 23500 and 23900 ranges and assist at 23000.

+ There are no comments

Add yours