Buyers might glean extra on the Federal Reserve’s resolve to ease and the way shut Japan is to lastly exiting detrimental rates of interest as central banks set coverage for nearly half the worldwide financial system.

Article content material

(Bloomberg) — Buyers might glean extra on the Federal Reserve’s resolve to ease and the way shut Japan is to lastly exiting detrimental rates of interest as central banks set coverage for nearly half the worldwide financial system.

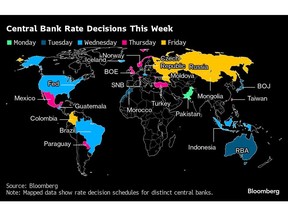

The approaching week options the world’s largest assortment of selections for 2024 thus far, together with judgments on the price of borrowing for six of the ten most-traded currencies. The collective end result might underscore how financial officers’ notion of inflation dangers is diverging noticeably.

Commercial 2

Article content material

Article content material

That will mirror how a worldwide consumer-price shock within the wake of the pandemic, additional exacerbated by Russia’s warfare in Ukraine, has transitioned asymmetrically, with some economies going through stronger home worth pressures than others.

In flip, the world now contains a patchwork of various coverage dynamics, in distinction to the largely synchronized response that central banks beforehand engineered.

Most consequential would be the Fed’s resolution on Wednesday, which can reveal whether or not still-robust financial knowledge are giving Washington officers trigger to dial again intentions to chop charges — or whether or not their outlook for 3 reductions this yr stays on observe.

The Financial institution of Japan’s announcement on Tuesday can also be pivotal. The prospect that it’s transferring towards lastly elevating borrowing prices and successfully calling an finish to a generation-long interval of feeble worth development factors to how tectonic plates are shifting in one other key member of the worldwide monetary system.

In Europe, in the meantime, central banks from the UK to Switzerland would possibly inch towards lowering borrowing prices, whereas all 4 with selections in Latin America within the coming week are poised to both start or prolong easing cycles.

Commercial 3

Article content material

Click on right here for what occurred final week, and beneath is a have a look at the financial highlights anticipated over the subsequent 5 days.

Monday

Pakistan might be Monday’s major fee occasion. With a crew of Worldwide Financial Fund officers visiting this weekend for talks over the troubled financial system’s mortgage program, most forecasters in a Bloomberg survey reckon the central financial institution will preserve its fee unchanged at 22%.

A minority does anticipate a reduce, although, with predictions of its dimension starting from 1 / 4 level to a full proportion level.

Tuesday

The BOJ’s resolution might be among the many most intently watched in many years, as officers resolve whether or not to finish the world’s final detrimental fee now, or wait till April.

The assembly comes days after the nation’s largest umbrella group for unions introduced that annual pay negotiations resulted within the largest will increase in additional than 30 years, sending a sign to authorities that their long-sought-after virtuous cycle of sturdy wages fueling demand-led inflation could also be rising.

The raises outpaced inflation in a constructive signal for households which have seen actual wages fall each month for nearly two years. Economists are divided on whether or not the central financial institution will transfer Tuesday or not.

Article content material

Commercial 4

Article content material

“We predict it would decide that it’s too early to tighten,” Taro Kimura, senior Japan economist at Bloomberg Economics, stated in a report. “To make certain, there’s a important threat to our name.”

The identical day, the Reserve Financial institution of Australia will in all probability maintain its money fee at 4.35% after weaker-than-expected inflation in January. Buyers will concentrate on whether or not the establishment retains its hawkish tone or hints at a pivot just a few months out.

And later in Morocco, with inflation having slowed to 2.3% in January, the central financial institution might choose to maintain its fee regular on the 3% stage it reached a yr in the past.

Wednesday

A trio of selections in Europe and Asia would possibly pique traders’ curiosity earlier than the day’s major occasions. Firstly, Indonesia’s central financial institution is seen maintaining charges on maintain.

Over in Europe, Iceland might start easing with a quarter-point reduce from 9.25% — the very best stage in Western Europe — based on lender Islandsbanki hf. Slowing inflation and a long-term pay deal might present officers with reassurance in opposition to a possible wage-price spiral.

The Czech central financial institution is poised to behave extra aggressively, with most economists anticipating a half-point discount and one predicting a much bigger transfer.

Commercial 5

Article content material

Consideration then shifts throughout the Atlantic, the place the Fed is broadly anticipated to carry charges regular for a fifth consecutive assembly, and to proceed to mission three quarter-point fee cuts in 2024, at the same time as inflation has confirmed stickier than anticipated the previous two months.

After elevating their benchmark federal funds fee greater than 5 proportion factors beginning in March 2022, the Federal Open Market Committee has held borrowing prices at a two-decade excessive since July.

In opposition to the backdrop of sturdy job development and a soar in costs in January and February, officers have repeatedly emphasised they’re in no rush to ease.

Most economists surveyed by Bloomberg Information count on the policymakers to pencil in three cuts for 2024, with the primary transfer coming in June, in step with markets’ present pricing, although greater than a 3rd count on a hawkish shock of fewer reductions.

Chair Jerome Powell informed Congress this month that the central financial institution is getting near the boldness it wants to start out reducing charges, saying they had been “not far” from that when contemplating the energy of inflation.

Commercial 6

Article content material

For later within the day, Brazil’s central financial institution has telegraphed {that a} sixth straight half-point reduce is on faucet, which might take the important thing fee right down to 10.75%.

The establishment’s board, led by President Roberto Campos Neto, might shorten the horizon on present steering, which alerts cuts of “the identical magnitude within the subsequent conferences” after three straight above-forecast inflation prints.

Economists see a year-end fee of 9%, however the coverage path from there stays much less clear as neither the central financial institution nor analysts see client costs again to focus on earlier than 2027.

Thursday

Three selections will reveal how components of Western Europe have reached a crossroads in financial coverage.

Firstly, the Swiss Nationwide Financial institution is anticipated by most economists to remain on maintain, although two respondents in Bloomberg’s survey predict that officers will reduce charges, opting to not look forward to greater counterparts to start out their very own easing cycles.

Shortly after that, Norges Financial institution can also be anticipated to maintain borrowing prices on maintain, with traders specializing in potential adjustments in its outlook for when reductions would possibly begin. Most economists nonetheless see the pivot to easing in Norway no sooner than within the third quarter, at the same time as inflation has been cooling sooner than anticipated.

Commercial 7

Article content material

Financial institution of England policymakers could have contemporary inflation knowledge on Wednesday and the most recent buying supervisor surveys on Thursday to think about earlier than their resolution, which is seen prone to preserve charges unchanged once more.

With consumer-price development slowing however prone to nonetheless are available in nicely above the two% goal, the UK central financial institution is in no rush to maneuver towards easing for now.

Observers are prone to concentrate on the vote depend from officers on the Financial Coverage Committee, with one other three-way break up potential between these wanting no change and others favoring both a reduce or a hike.

“Having dropped its tightening bias at its February assembly, we don’t assume the MPC might be minded to change its steering,” Dan Hanson and Ana Andrade of Bloomberg Economics wrote in a report. “A much bigger shift in tone is prone to are available in Could.”

Buyers may even intently watch Turkey’s fee resolution after February’s inflation numbers got here in larger than anticipated. A number of banks, together with JPMorgan, say financial officers will in all probability elevate the important thing fee past its present stage of 45%, although most doubt that may occur till after this month’s native elections.

Commercial 8

Article content material

The main target will once more shift to Latin America later within the day. In Mexico, officers might lastly pull the set off on a long-awaited reduce — seemingly 1 / 4 level — and by doing so be a part of main friends throughout the area in easing financial coverage.

Banco de Mexico, led by Governor Victoria Rodriguez, has saved borrowing prices at a record-high 11.25% since final March whereas client costs have launched into a protracted and bumpy path downward.

In one in every of Latin America’s smaller economies, Banco Central del Paraguay will seemingly reduce its key fee for an eighth time since August, from the present 6.25%, after inflation slowed to 2.9% final month.

Friday

The Financial institution of Russia’s first post-election fee resolution is prone to preserve borrowing prices unchanged for a second straight time, following final month’s maintain at 16%. With inflation at 7.7% — nicely above its 4% goal — the central financial institution has stated it sees room to start reducing borrowing prices solely within the second half of the yr.

Afterward, Colombia’s central financial institution is all however sure to chop the present 12.75% fee for a 3rd straight assembly — and should choose to go greater after consecutive quarter-point reductions.

Commercial 9

Article content material

Policymakers led by Governor Leonardo Villar do have room for maneuver: inflation has slowed for 11 months and Colombia’s financial system is working nicely wanting potential.

Financial Information

The approaching week may even characteristic some key knowledge releases:

- China’s month-to-month batch of numbers might present development in retail gross sales and industrial output slowed within the first two months of 2024, whereas property funding might have dropped 8% on yr.

- US statistics on the schedule embrace housing begins and PMI numbers.

- Canada, Japan, South Africa and the UK will all launch inflation knowledge.

- Euro-zone experiences due embrace PMI surveys and client confidence.

- Germany’s ZEW and Ifo indicators will present a snapshot of the potential restoration of Europe’s largest financial system.

- Singapore, Malaysia, New Zealand, Japan and South Korea publish commerce knowledge.

—With help from Brian Fowler, Piotr Skolimowski, Robert Jameson, Monique Vanek, Paul Wallace, Kira Zavyalova, Steve Matthews and Ott Ummelas.

Article content material

+ There are no comments

Add yours