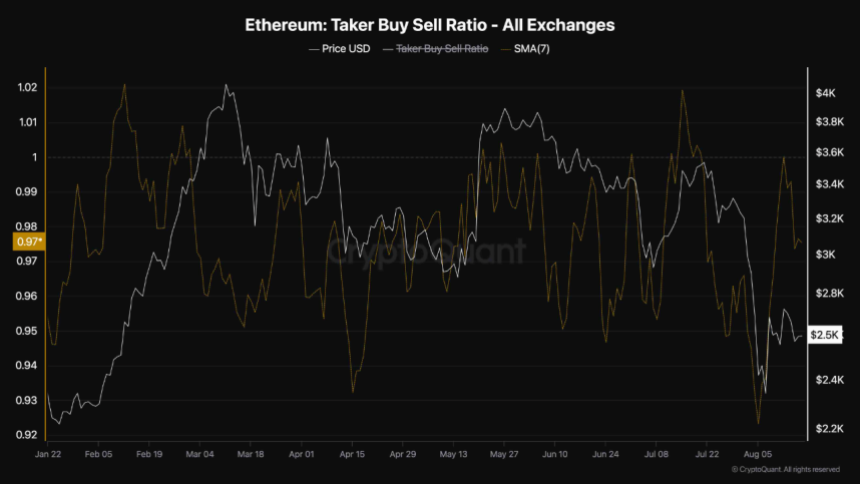

Welcome to your daily dose of Ethereum news! Buckle up, because it seems like Ethereum is on a bit of a rollercoaster ride lately, and we’re here to break it all down for you. First off, the price of Ethereum (ETH) has been a hot topic, especially after it took a nosedive of about 30% earlier this month, hitting a low of $2,226. But hold on! It managed to claw its way back into the $2,600 range recently. So, what’s the deal? Well, analysts are saying that despite the recent recovery, Ethereum might just be gearing up for another bearish trend. According to a report by NewsBTC, the Taker Buy/Sell Ratio has dropped, indicating a potential dominance of sellers in the market.

ShayanBTC, a CryptoQuant analyst, pointed out that this ratio is a crucial indicator of market momentum. A ratio above one typically means buyers are in control, while a ratio below one signals the opposite. Currently, the ratio is hovering in the zero region, suggesting that sellers are gearing up to offload their assets. This could spell trouble for Ethereum’s price, as the market needs a significant uptick in demand to avoid further declines.

But that’s not all! In another twist, Metalpha, a digital asset management firm, has withdrawn a whopping 10,000 ETH (worth around $26 million) from the staking platform Lido and transferred it to Binance. This kind of movement could indicate bearish sentiment, especially since transferring assets to an exchange often suggests that the holder might be looking to sell. So, if you’re holding ETH, you might want to keep an eye on this situation!

On the price front, Ethereum is currently trading around $2,610, reflecting a slight gain of 0.61% over the last day. However, the performance over the past month is less than stellar, showing a decline of nearly 24%. If the buying pressure can hold up, ETH could potentially break the $2,700 resistance level, but with the current selling pressure, it could also dip back down to $2,300.

And let’s not forget about inflation! Ethereum’s supply has been a hot topic as well, with the circulating supply surpassing 120 million ETH. Unlike Bitcoin, which has a fixed supply, Ethereum is designed to be inflationary. Recent data shows that Ethereum’s supply has been growing, with over 210,000 ETH added to circulation recently. This trend could put downward pressure on ETH’s price if demand doesn’t keep pace. According to NewsBTC, the annual inflation rate for Ethereum is currently around 0.70%, which is something to watch.

In summary, Ethereum is navigating a tricky landscape right now. With bearish sentiments looming due to the Taker Buy/Sell Ratio, significant withdrawals from staking platforms, and ongoing inflation concerns, it’s a wild time to be involved in Ethereum. Keep your eyes peeled for more updates, and remember to stay informed!